How Much Do We Charge? Know Your Costs! Don’t Lose Money!

You’ve gotten yourself a tractor and some implements, and you’ve done a few projects for friends and family. Maybe you did such an excellent job that your dad’s-friend’s-neighbor’s-dog’s-godmother’s -facebook friend’s-cousin has asked you to help them with a project next. You’ve made it to the Tractor Business Big Leagues – and it’s time to start charging for your work. But one big question remains… how much do you charge for a project? The answer might be a little higher than you’re imagining. Let’s look into it.

This post accompanies a Tractor Time with Tim video on the same subject. If you haven’t already seen the video, click the link here for a quick overview:

Estimating Your Costs

We’ve published a spreadsheet to help you think through all of the various costs you may have. You can download that *here* and then change the numbers to your own estimates. The total costs will automatically update as you go.

How Much Work in a Year?

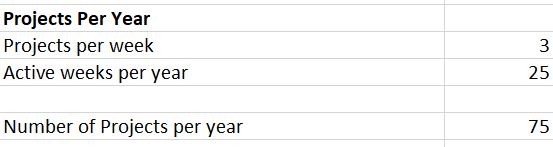

Number of Projects Per Year

We’ll compute this by determining how many projects you do in a typical week, and then how many active weeks you have in a year. We estimated 3 projects per week and 25 active weeks per year (the ground freezes here in Indiana), giving us a total of 75 projects. Edit these as you see fit to get your total number of projects per year. This will automatically update as you change the ‘projects per week’ and ‘active weeks per year’ numbers.

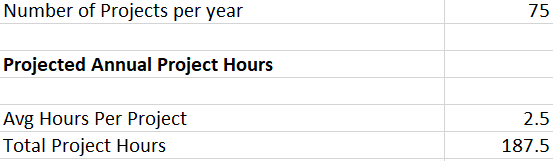

Typical Project Length in Hours

Next, we need to estimate how many hours we spend at each project. We went with 2.5, assuming that we do some simple projects (tilling a garden) and some lengthy ones (say, building up dirt to pour a driveway on). If your typical project is longer or shorter, adjust the ‘Avg Hours Per Project’ number. The ‘Total Project Hours‘ – the number of hours we expect to be actively working on projects per year – will automatically update.

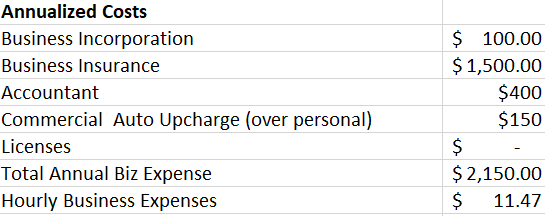

Annual Costs

The first annual cost to consider is ‘Business Incorporation‘ which only applies if you have an LLC or small business through which you do your tractor work. If you don’t have this, simply put ‘0’ in that category. Next, we need to look at insurance. In the ‘Business Insurance’ row, enter your costs for any sort of insurance you have. If you don’t have insurance, you might consider getting some just in case you run into an unexpected water line – but for now, just put a ‘0’ in that category. If you run a business with any sort of complexity at all, you’ll probably have an accountant – so add those costs in the ‘accountant’ row. We also want to consider the additional costs that commercial auto insurance has over personal auto insurance. For us, this is about $150, but if you don’t have a business, this might be ‘0’. Additionally, if you need licenses to do your work, add those here. The ‘Total Annual Biz Expense‘ line will automatically update based on your inputs. Then, that line is divided by your ‘Total Project Hours’ to come up with ‘Hourly Business Expenses‘.

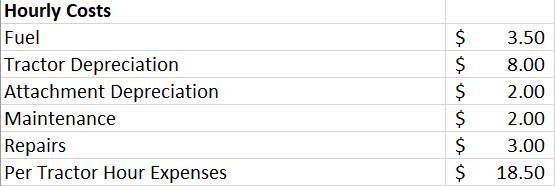

Hourly Costs

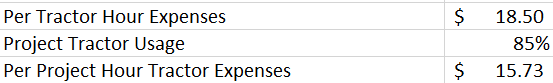

Some business costs depend on how much you use your tractor – the most obvious of which is fuel. Most small tractors use about 1 gallon of fuel per hour, and at the time of writing, diesel is about $3.50 in Indiana. If the price of fuel is different in your area, update the ‘fuel’ row. We also want to consider how much of the value of our tractor we are using each hour, or how much it depreciates. After looking through many sources, we’ve come up with about $8/hr for a typical 25 horsepower tractor. If you have a much smaller or much larger tractor, you might want to alter the ‘tractor depreciation’ row. We’ve estimated that attachments depreciate at around $2/hr, but if you think your ‘attachment depreciation’ is much higher or lower, update it here. Routine maintenance like grease and oil changes are also a must. We’ve estimated ‘maintenance’ at $2/hr. And, sadly, we tend to break things every so often – we estimate that $3/hr would hopefully cover for the ‘repairs‘ and parts that just happen to break as we do projects. All of these things contribute to ‘Per Tractor Hour Expenses‘.

Tractor Running Time

It’s rare to run your tractor the entire time you’re at the project – we’ve estimated that the tractor is running only about 85% of the time. You can adjust this up or down based on the types of projects you normally do. This will update the ‘Per Project Hour Tractor Expenses‘ – which totals tractor operation costs in terms of project hours, not tractor hours.

Travel Costs

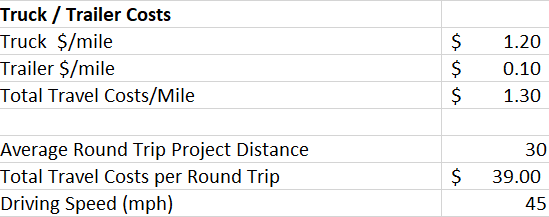

You’ve got to get your tractor to the project somehow. We’ve chosen to use a mileage cost measure for trucks and trailers, which includes fuel, maintenance, and depreciation. For our Ford F350, we think this number is around $1.20/mile – but you can use Edmunds.com to get a more accurate estimate for your specific vehicle. For a trailer, we simply estimated $0.10/mile. Since we drive a truck with a trailer to a project, our total per-mile cost is $1.30. Then, we estimate the average round-trip to a project from our property. You can edit ‘truck $/mile’, ‘trailer $/mile’, and ‘average round trip project distance‘ to your liking, and this will automatically update the ‘total travel costs/mile‘ and ‘total travel costs per round trip‘ rows. While you’re at it, go ahead and give an estimate of how fast you can drive with your tractor – this will help us with time estimates later.

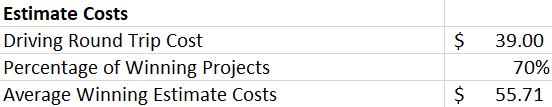

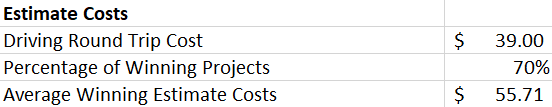

Project Estimate Costs

Most tractor projects, especially complex ones, need an estimate beforehand. This helps you understand exactly what you’re going to be doing and allows you to meet the person you’ll be working with ahead of time. The round-trip driving costs will likely be very similar here to when you drive to the project, so the ‘driving round trip cost‘ row will directly populate with the ‘total travel costs per round trip’ figure from the previous section. While we might end up doing most of the projects that we estimate, it’s likely we won’t “win” them all. We’ve guessed that our ‘percentage of winning projects‘ is around 70%, but you can update this as you see fit. We then divide our ‘driving round trip costs’ by the ‘percentage of winning projects’ to come up with the ‘average winning estimate costs‘ – which will automatically update.

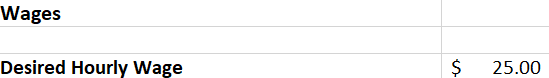

Wages (Pay Yourself!)

We may have discussed a lot of the hard costs here, but a very important question still remains – how much do you want to be paid? This could vary widely depending on the cost of living in your area and your skill/experience level. For simplicity, we chose $25 as our ‘desired hourly wage’. You can update this as you see fit.

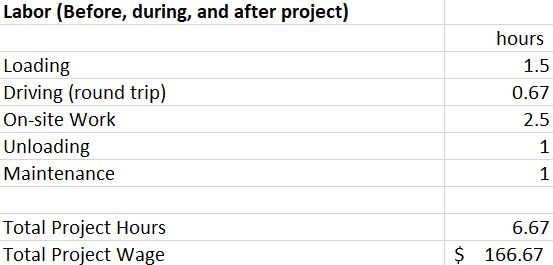

You want to get paid for all of the time you spend on your project – including projects, maintenance, loading, and the project itself.

Project Estimates

Your ‘driving time‘ for your estimate will automatically update based on your ‘average round trip distance’ and ‘driving speed’ rows. We typically spend about 1 hour onsite for the estimate, but you can change the ‘on site estimate time‘ to your liking.

Some Projects Are Losers!

We don’t win every project we estimate. Sometimes this is a GOOD thing. That point aside, even if we don’t get the project, we’ve still spent time AND money on the estimate. We need to recover that on the projects that we DO win.

To account for this, we multiply by our desired wage and divide by our percentage of winning projects to calculate our ‘average winning estimate wages‘ – how much we’ll add to the price of the project to pay for our estimate time.

Project Day!

When the time comes for the actual project, you will have to spend time loading, driving, unloading, and performing maintenance in addition to the onsite work. You can update each of these categories, which will automatically update the ‘total project hours‘ row. We then multiply by our desired wage to come up cost for our labor related to the project itself.

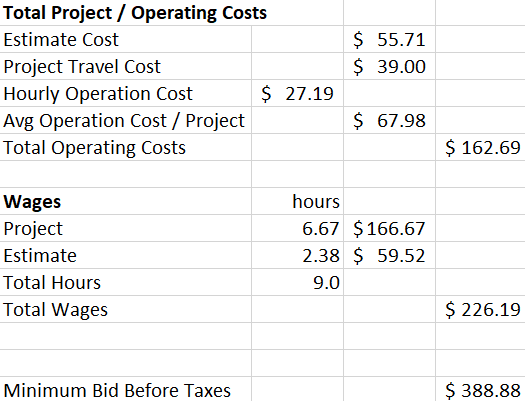

Let’s Get Some ANSWERS!

Now, we’ll go to the summary section on the right side of the spreadsheet. All of these boxes will automatically update depending on what you’ve entered in the rows we’ve already discussed. You’ll be able to see what your ‘total operating costs’ and ‘total wages’ will be, which when added together come to our ‘minimum bid before taxes’.

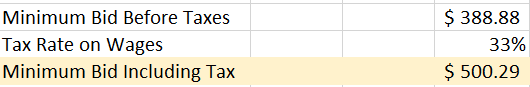

The Tax Man

We all know that whether we like it or not, Uncle Sam comes around asking for his share. All of your costs besides labor should be deductible, meaning that we only need to pay taxes on our wages. We’ve estimated a 33% tax rate on our wages, but this will be different depending on your specific tax situation. Update the ‘tax rate on wages‘ row accordingly. That will update your ‘Minimum Bid Including Tax‘ row – which is what we recommend you estimate for a typical tractor project based on the criteria you entered.

For us, our ‘minimum bid including tax’ came out to just over $500 for a 2.5 hour project. This is likely much higher than you might estimate off the top of your head, but it’s important to think through all of the costs and all of the time that really go into a tractor project. Otherwise, you might be unintentionally losing money, or at least not making nearly as much as you think. Even if you don’t go through all of this math yourself, remember that your costs are probably higher than they appear at first glance – and your estimates should be, too.

You might need to make some additional changes depending on your specific situation, for instance, if you have employees, licensing fees, or multiple tractors and trailers. For these more complex scenarios, you may have to make significant alterations to our model – but we hope that our spreadsheet will be a helpful starting point for those who have fairly simple, streamlined operations. Let us know if you have comments, questions, or ideas in the comments below – and enjoy running your very own tractor business!

Great information thank you so much.

Thanks for reading and watching, Jacob! Welcome to Tractor Universe!

We could use your help here. Lots of questions already on this new community site.

First off just wanted to say thanks for putting this together. Very comprehensive. I did a very similar exercise with my own tractor based company I’ve just started. For my purposes, one difference in my approach was to use the amount of time you’re allowed to depreciate assets to determine how much depreciation you absorb per year for tax purposes. Since that’s a cost you’ll incur no matter what other decisions you make, I treated it as fixed and used my expected use to determine how much fell against each operating hour. It sounds like that may be what you did, just wasn’t sure. I’ve got those formulas built into my own spreadsheets that allow me to classify an implement purchase for example a certain way, and my total depreciation for the business is updated on a calendar basis. In sole proprietorships and small LLCs the whole operation has to carry all the depreciation because it’s taxed as one entity. Getting way into the weeds, I just enjoy seeing many approaches because they always lead to good ideas. Unlike Katriel who’s education seems to have been very exciting and interesting, I went for business degrees and an MBA to boost my management roles in my career. So much more boring! LOL

NOTE: The two previous comments on this article don’t show up in my browser. There are white place holders there, but the font of the comments is in white. To read them you have to highlight the comment. Should be a quick fix! Tractor Universe is off to a great start!

Yes, I noticed that the comments were white on white. These are the first two comments we have received! That shows how new the site is! We’ll get this fixed as soon as possible.

Thanks for your kind words. We are excited about the possibilities.

Fantastic explanation of business costs and spreadsheet. Greatly appreciated!

Thanks Tom!

Tim, Katriel,

Thanks for the lesson plan and lessons on getting and keeping business. I recently used your approach for calculating a job, I used to say what ever you think it’s worth. Yeah not a lot of cash flow that way, lucky to cover expenses.

Being new to tractor play I basically wanted the experience, which was good. Now I am ready to retire and ready to start using Gus (LX3310) to supplement the pension.

I was approached by a homeowner living down the road and asked how much to remove a hedge row of lilac bushes/trees ,these were 60 yr old, never trimmed hedges, 120 ft x 4 ft wide footprint.

I went through the list with the owner:

we’ll cut down and stack the above ground,

grappel and haul away,

pull out the stumps and root ball

again grapple and haul away.

looking at terrain it seems fairly possible we’ll run into lots of large stone in the process this will take extra time to deal with and or work around.

were looking at right around xxx.xx

We completed the job in less than 3 hours and came out ahead on that job.

Thank you very much for the bits of wisdom.